Every day of the week, the US Treasury Department issues a “Daily Treasury Statement” (DTS). A normal DTS is majorly bland. For instance, here is a link to the March 29 DTS. As you can see, it is a four-page PDF of unlimited numbers and line items including “DOL – Pension Benefit Guaranty Corp” and “DOI Gas and Oil Lease Proceeds.”

Nevertheless, not all line items and numbers within the Daily Treasury Statement are bland. From time to time, some interesting financial secrets hide in the blandness. For instance, one line item in the February 28 Daily Treasury Statement might have unexpectedly exposed a recently-deceased anonymous American who had a massive hidden fortune.

A fortune that would indicate that somebody out there was secretly living as one of the 40 richest people in America… and nobody had a clue.

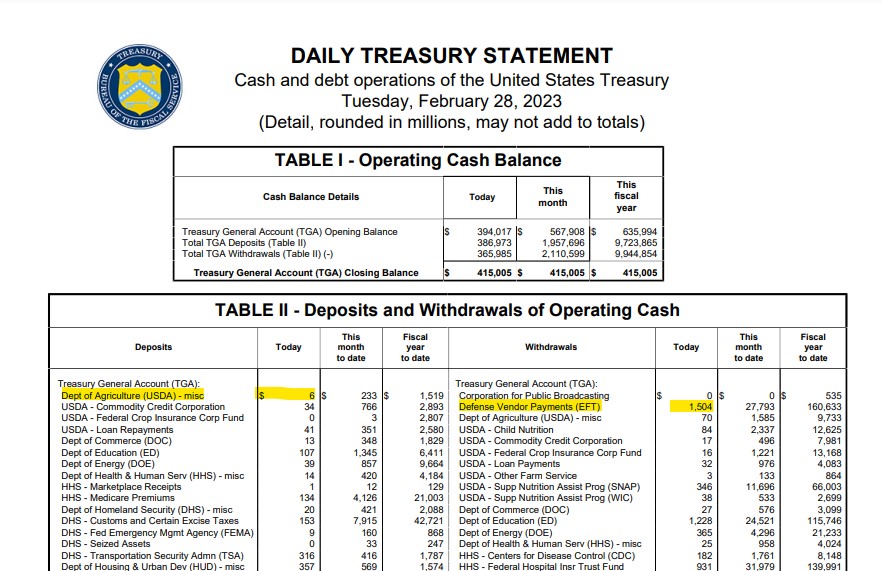

Here is a picture of the top part of the February 28 Daily Treasury Statement:

As you can see, on the left the DTS lists ‘Deposits’, and on the right is a list of ‘Withdrawals.’

These numbers are rounded in millions. Hence, for instance, on February 28 the Department of Agriculture deposited $6 million to the treasury. This month, the Department of Agriculture deposited $233 million. Fiscal year to date, the deposits have reached $1.5 billion.

As a withdrawal example, on February 28 the Treasury withdrew $1.5 billion to make “Defense Vendor Payments (EFT).” Month to date, these payments have totaled $27.79 billion, and Fiscal year to date, the amount has reached $160 billion.

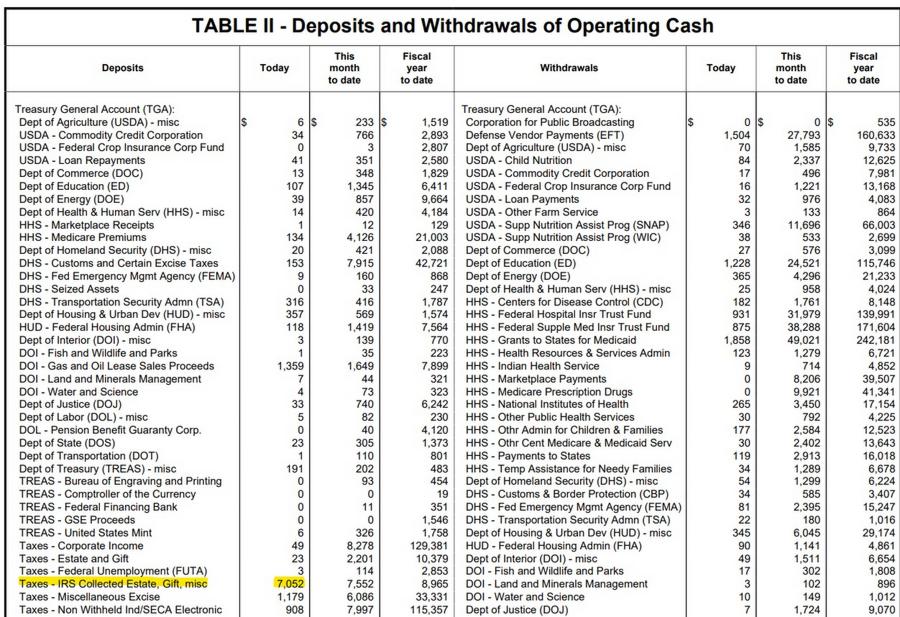

Here is an extensive and zoomed screenshot of the February 28 DTS. Please look keenly at the highlighted line item listed as…

“Taxes – IRS Collected Estate, Gift, misc”

$7 Billion Mystery Deposit

As the name suggests, the line item represents money got by the Treasury either from estate taxes OR individual gifts. Because just an absolute psychopath would leave a gift to the Treasury out of their willing goodness, let us assume this makes up a small amount of the $7+ billion total.

It only means that some recently-deceased individual sent a $7 billion estate tax payment to the Treasury on February 28.

To offer some perspective on how big and weird such a deposit is, analysts went through many DTS reports, and on most days there are no amounts reported. On the days where there is an amount reported, it is mostly the low single-digit millions, like $1-3 million. Based on the Treasury, $7 billion is the biggest IRS deposit it has got since 2005.

Whenever someone dies, their estate has nine months as stipulated by law to pay the estate tax. Also referred to as the ‘death tax,’ in case you die with a net worth of more than $12 million, you are mostly expected to pay a 40% tax on the value of your estate. Hence, if you passed away with a net worth of $100 million, your estate would have to pay 40% of $88 million [$100m – $12m] = $35 million.

A $7 billion estate tax debt would mean that somebody with a net worth of $17 billion died in recent months. In other words, between May 28 and February 28, an American with a $17 billion net worth died.

A $17 billion net worth would be one of the 90 biggest fortunes on the planet. That amount would make someone the 37th richest person in America, just behind Laurene Powell Jobs (Steve Jobs’ widow).

Any billionaire death always makes the news. The death of one of the 40 richest people in the US would be a big deal. Youthful Investor, Fortune, Forbes, the Financial Times, the Wall Street Journal, and many others would have extensive obituaries. Wealth rankings would have to be adjusted. Newly-minted billion-heirs would possibly be added to the ranks of the richest citizens in the world.

Yet, here we are. From this research, nobody can identify any American who died in the past nine months with a $17 billion fortune.

The only richest (known) American who died in 2022 was Fidelity Investments billionaire Edward Johnson III. He had a net worth of $10 billion when he passed away on March 23, 2022. Not only is $10 billion not adequate to make his estate the anonymous February 28 depositor but by the nine-month rule, whatever estate tax his estate paid would have been due before December 23, 2022.

This is a real wealth mystery.