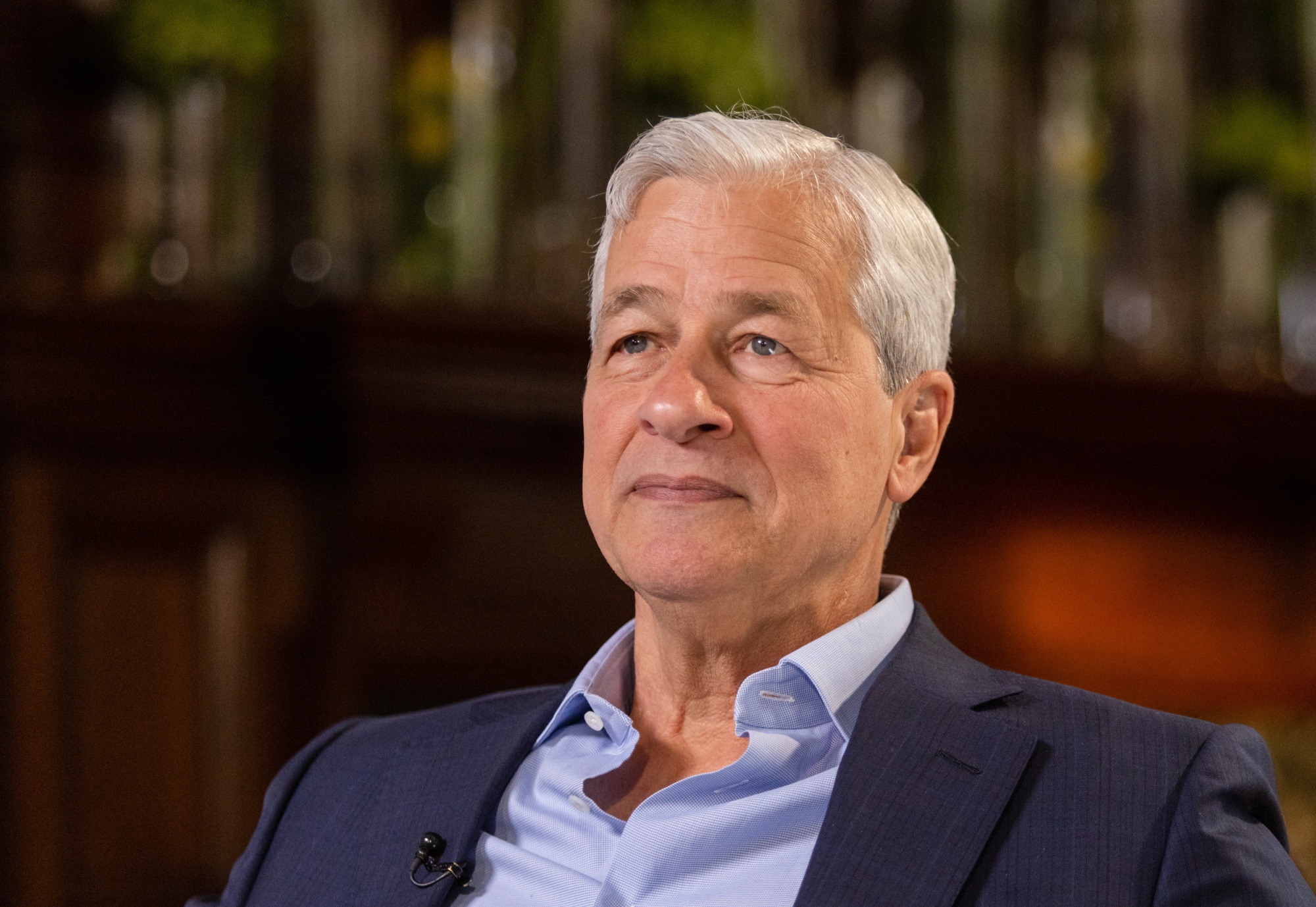

Jamie Dimon is the current CEO and Chairman of JPMorgan Chase & Co. He has been CEO of this bank since 2005.

Janet Yellen is the current US Secretary of the Treasury. She has been Treasury Secretary since January 2021.

Jamie Dimon’s base salary is $1.5 million, but his total compensation in a normal year, with bonuses and several other awards, comes to nearly $35 million. That is nearly what he has been earning annually for the last decade. Notably, since he became CEO in 2005, Jamie has earned a $200 million salary and bonuses. This does not include the stock grants or dividends. Only salary and bonuses.

On the other hand, Janet Yellen’s base salary this year is $221,000. She does not earn a bonus.

So, you now have $35 million vs. $221,000.

Yet, even with that gross compensation difference, when the time comes there is a majorly strong possibility that Jamie Dimon will be looking to succeed Janet Yellen as Treasury Secretary. Why? Because of a little-known, much-valuable tax loophole…

After completing his studies at Harvard Business School, Jamie Dimon secured a position at American Express, coincidentally joining a company where his father held the role of executive vice president. In 1985, he transitioned to a firm named Commercial Credit. Over time, because of various mergers and acquisitions, Commercial Credit evolved into what is now known as Citigroup.

However, Jamie’s tenure at Citigroup ended in 1998 when he departed from the company. At that juncture, he made a significant financial move by selling the 2.3 million shares he owned, resulting in a substantial pre-tax windfall of $110 million.

In 2000 he became the CEO of Bank One, which at the time was the fifth-biggest bank in the United States. Later in 2004, JPMorgan purchased Bank One. ON New Year’s Eve 2005, JPMorgan named Jamie CEO.

Boasting a staggering $430 billion market capitalization, JPMorgan stands as the foremost bank globally when considering its overall company worth. In contrast, the world’s second-largest bank, Bank of America, holds a value of $230 billion. JPMorgan further solidifies its position as the world’s preeminent private bank by commanding an impressive $3.665 trillion in total assets.

It’s worth noting the term “private bank” here, as it distinguishes JPMorgan from the four state-owned Chinese banks, which collectively possess assets ranging from $4 trillion to $6 trillion.

Jamie Dimon’s net worth is around $2 billion. He first became a billionaire in 2015 and, remarkably, he is one of the very few individuals in history who have managed to become a billionaires without having been a founding employee of a company.

At the time of writing, Jamie has 8.63 million shares of JPMorgan. Using a recent average price per share of $150, these shares are worth nearly $1.3 billion.

The additional $700 million of his $2 billion net worth consists of $100 million worth of real estate and $600 million in non-JPMorgan financial holdings, assets, and Equities.

Tax Loophole

Before accepting one of a handful of high-level Executive Branch government positions, candidates must liquidate all of their stock holdings. This is a requirement so that any possible conflicts of interest are eliminated. This makes a lot of sense.

The decision that is made by the Treasury Department directly affects the stock market, mostly banking sector stocks. Hence, to insist, before taking the job, individuals subject to this regulation must liquidate their equity positions and place the money they get into a blind trust.

Recognizing that this regulation could deter exceptionally skilled individuals from ever contemplating a low-paying government position, a tax incentive was established in 1989. This particular exemption applies to only a select few top-tier roles within the Executive Branch, and among them is the position of Treasury Secretary. Notably, it does not extend to members of Congress.

Based on the loophole, qualifying persons are offered a one-time chance to sell all stock that they own without having to pay a dime in capital gains tax. The highest rate of Federal Capital Gains tax is 20%.

Do you see where this is going?

If Jamie Dimon ever puts himself in such a position to get nominated and confirmed as Treasury Secretary, he will get a one-time chance to sell all of his stock holdings, tax-free. Let us focus on his JPMorgan stock, which is common stock equities. This means he can sell all 8.63 million shares without paying any taxes.

In the case that he was taking this job today, he would sell $1.3 billion worth of shares without incurring 20% in capital gains. Under normal circumstances, Jamie would pay nearly $300 million in capital gains taxes on that sale.

Additionally, if Jamie’s non-JPMorgan financial holdings, totaling $600 million, consist of publicly traded equities, these would also qualify for tax-free sales. In this scenario, when combined with his JPMorgan shares, Jamie would benefit from a one-time, tax-free sale amounting to $1.9 billion in stocks. This would otherwise have incurred a substantial IRS tax liability of approximately $400 million.

If you find it hard to believe that individuals would willingly depart from influential corporate finance positions and liquidate their multi-decade-earned stock holdings to leverage a tax loophole before assuming the role of Treasury Secretary, it’s worth noting that this is precisely the course of action taken by several recent Treasury Secretaries.

Before Henry Paulson became Treasury Secretary in 2006, he was the CEO of Goldman Sachs for seven years between 1999 and 2006. In July 2006, Paulson liquidated 3.23 million shares of Goldman. He sold these shares at an average price of $152 per share. After the sale, Paulson enjoyed a tax-free gain of $491 million.

In retrospect, it appears that Henry should have retained his Goldman Sachs stock. Presently, Goldman Sachs commands a market capitalization of $100 billion. A 1% ownership stake in the company would translate to an exact pre-tax value of $1 billion.

In case Henry had maintained ownership of these shares today, he would be liable for a 20% capital gains tax, in addition to a 5% state tax as an Illinois resident. Consequently, his tax obligation would amount to approximately $250 million, leaving him with a net profit of $750 million.

On the other hand… if Henry just invested his $491 million profit in the S&P 500 in July 2006, and then left it for 17 years untouched, he would have $1.3 billion today. After taxes, it would be about $975 million.

No bad options there.

The bottom line is that when Jamie Dimon decides to try to become the Treasury Secretary, you will know one of the reasons that inspired his decision.