One of the most popular financial technology solutions on the market is Personal Capital. Personal Capital was founded in 2009 with the purpose of combining cutter technology with impartial financial advice, providing retirement and budgeting tools. The firm has risen by advancements, now managing over $12 billion in assets. We’ve repeatedly ranked Personal Capital as the top personal finance app because we’ve been so impressed with its broad selection of services and capabilities.

First and first, it’s important to clarify that Personal Capital does not want to be labeled a Robo-advisory, preferring to be referred to as a digital signage service that also provides customized financial planning assistance.

Nonetheless, the firm was one of the first to put tools in the hands of investors and automate aspects of portfolio management. Due to the firm’s superior technology’s ability to properly manage risk and taxes, Personal Capital is our top pick for portfolio management.

What is Personal Capital and What Does it Do?

Personal Capital is a personal wealth management and online financial adviser based in Redwood Shores, California, with locations in San Francisco, Denver, Dallas, and Atlanta. Bill Harris, Rob Foregger, Louie Gasparini, and Paul Bergholm launched Personal Capital in 2009. SafeCorp Financial Corp was the previous name of Personal Capital. In 2010, the name was modified, and on September 9, 2011, it was officially launched.

Personal Capital has become a licensed investment advisor with the Securities and Exchange Commission (SEC) since 2012. Personal Capital was included on the CNBC Disruptor 50 list in 2014 and 2015. Personal Capital managed approximately $1.5 billion in assets as of June 2015.

Personal Capital’s free investment tools were used by 800,000 users in September 2015 to track $150 billion in assets. The National Basketball Players Association (NBPA) and Personal Capital collaborated on a financial education initiative in June 2016.

Personal Capital secured $25 million in Series E investment from IGM Financial in December 2016, bringing the total amount raised to $75 million. Empower Retirement, a Canadian-owned company located in Denver, announced in July 2020 that it will buy Personal Capital for $825 million plus a contingency dividend.

Personal Capital Review – Feature Overview

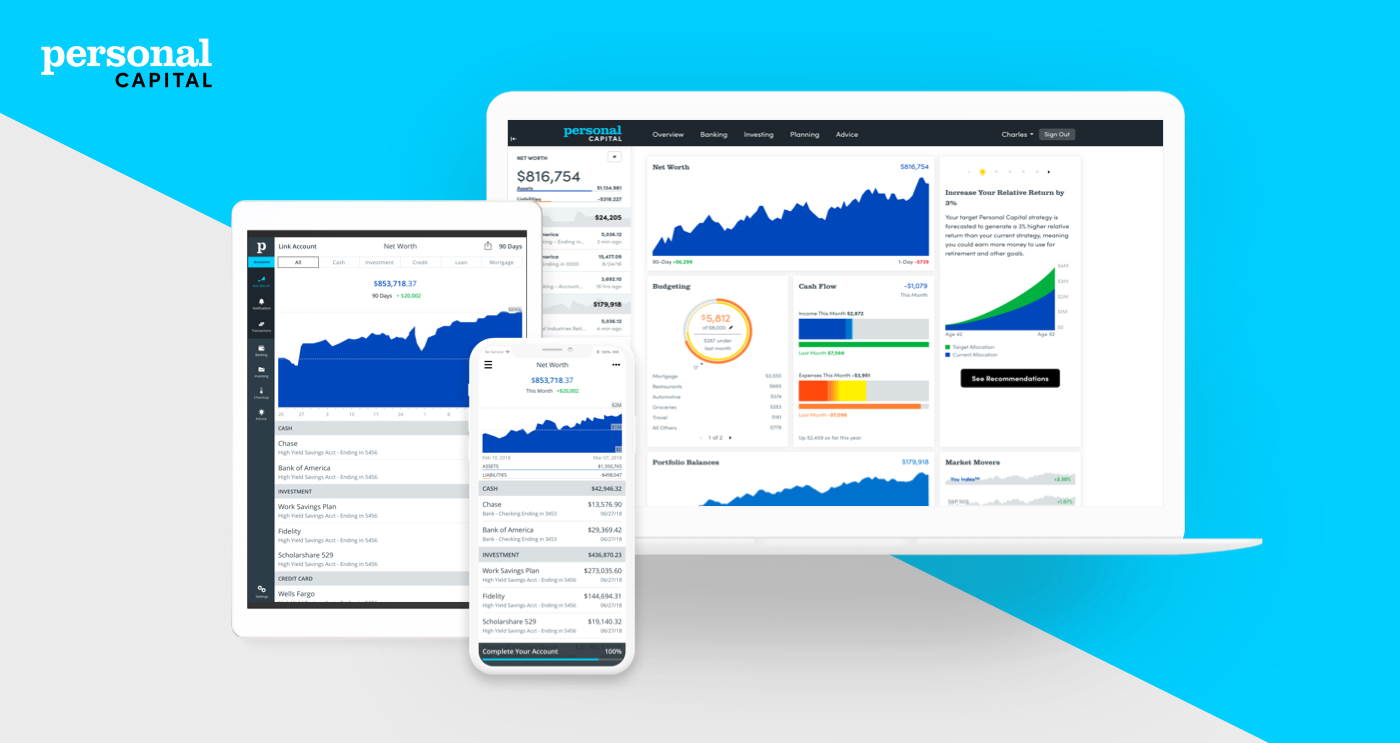

Personal Capital’s dashboard, which is included in the free service, allows you to see your whole financial picture in one location. Net worth, cash flow, portfolio balances, and portfolio allocation are all conveniently accessible. A holdings module displays the performance of all of your assets, allowing you to see them by the percentage of your portfolio, dollar amount, and whether they are “gainers” or “losers.”

College savings planning; financial decision assistance that includes insurance, home finance, stock options, and compensation; private banking services; and estate, tax, or legacy portfolio creation are among the tools and services available as the assets handled grow.

Though this version is frequently thought of as primarily a budgeting software, it is really rather restricted in that sense. The investing instruments, on the other hand, are vast. Even if you don’t plan to use Personal Capital for budgeting, the free edition will help you manage your investments.

The dashboard primarily functions as a financial aggregator, allowing you to add all of your accounts. Investments, savings, checking, loan accounts, and credit cards are all examples of this. It enables you to consolidate all aspects of your financial life into a single platform. You may also add any employer-sponsored retirement plans you have–the free version excels at this.

What Personal Capital Has to Offer

Personal Capital provides a number of free and useful tools, such as an investment checkup, a 401(k) fee analyzer, and a spending tracker. You don’t have to be a member of Personal Capital’s advising service to utilize them, but you must create login credentials.

Personal Capital also provides expenditure analysis, which is a breakdown of your cash flow by categories, such as grocery, health care, clothes, and restaurants. The application also keeps track of revenue sources and expenses due on linked accounts.

Personal Capital Budgeting

The free version may be used to keep track of your cash flow and spending habits. You may also look at your spending categories and transactions individually. You’ll receive monthly reports that will help you understand where your money is going. Personal Capital, on the other hand, is unlikely to be your first choice if you’re searching for budgeting software. For example, while the platform notifies users of impending expenses, it does not allow them to pay them. You’ll have to keep paying your bills with direct debits from your bank accounts.

Personal Capital Retirement Planning

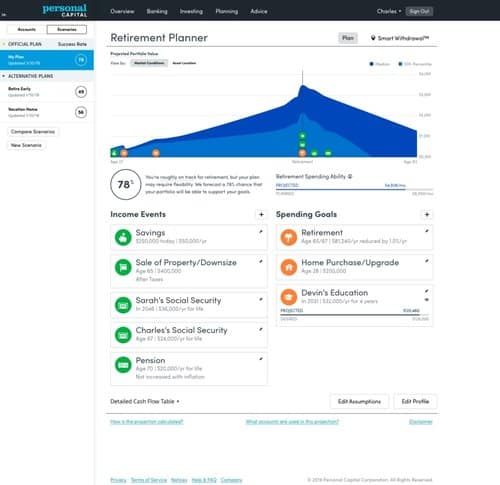

To assess if you’re on track with your retirement objectives, the planner utilizes a series of “what if” scenarios. Changes in your position, such as a job or profession shift, the birth of a child, or even saving for college, may all be accommodated. It considers external variables that may have an influence on retirement.

You can see when you’ll be able to retire with Personal Capital’s retirement tools, as well as how any large costs or wages increases may influence your retirement date.

Personal Capital Tax Optimization Strategies

Personal Capital’s investing strategy extends beyond tax-loss harvesting, aiming to reduce your overall tax burden rather than relying simply on tax-loss harvesting. Personal Capital employs individual stocks and bonds, as well as the various tax statuses of accounts, to better safeguard returns in its portfolios.

To keep today’s tax burden low, higher-yielding investments are placed in tax-deferred accounts like IRAs. Mutual funds are not utilized in any of Personal Capital’s managed portfolios since they can be inefficient in terms of taxes. Instead, ETFs are used to replace mutual funds in a portfolio.

The Biggest Advantage of Personal Capital – Unlimited Contact With A Personal Financial Planner

The company is believed to have the advantages that all the users are very satisfied. First and foremost, the major con of the company is considered to be the fact that clients are assigned to a financial advisor with whom they may communicate at any time. This means that the platform guarantees that all the users are connected to the advisors who are always online to give them assistance.

while engaging in the financial market, all the investors are frightened about the tax payments. However, the app uses tax optimization techniques to minimize the tax burden. Depending on which account the client is using, the Private Client services are available to high-net-worth clientele, this means that the service will be better analyzed and assist you with the more profitable suggestions. And the last but not least, the excellent retirement strategy of the Personal Capital should also be mentioned.

The Biggest Disadvantage of Personal Capital – A 100 000 Minimum Investment

It is no surprise that in the financial market, no company can guarantee you 100% profits. The limitations are everywhere. After the analysis of the client evaluation, major cons of Personal Capital were outlined. The first thing that should be mentioned is that customers with an investing account must deposit a minimum of $100,000. We all agree that this amount is a very high demand and not everyone who is interested in the investment can afford this minimum.

To consider more practical aspects, some essential elements that are only available on the desktop website are missing from the mobile app. Nowadays, people are traveling a lot of moving a lot and mainly they have access to the mobile phones more often than to their laptops, this is why it might be deterring for the users.

The process is not too quick and sometimes it requires to be logged in for a longer period, however, during the sign-up procedure, there is no clear option to opt-out of getting phone calls, and for a Robo-advisory, the fees are rather expensive, but their role is irreplaceable as of today.

Is Personal Capital Safe?

One thing we can say for sure is that Personal Capital is a safe place. The platform stores the account information you provide in Personal Capital in a one-way encryption token.

Personal Capital’s service does not allow you to make any withdrawals or transfers. It just displays what you have. All data transmitted over the service is read-only. Finally, your account information will not be visible anywhere unless you submit it in comment areas, which you should not do. The FDIC insures your account up to $250,000, which makes the users feel more secure if everything does not go as planned.

Does Personal Capital Have Fees?

Personal Capital’s free edition is, believe it or not, free. Although the firm offers the kind of personalized counsel you’d expect from a Robo adviser as well as sessions with real people – the free version has a lot of useful features.

The analyzer tools from Personal Capital should be regarded as an account service and one that you don’t have to pay for. The fee analyzer examines your allocations and fees to provide options that can either save you money or increase your diversification or both.

Because it pulls in all of your accounts, analyzes them, and provides suggestions on your overall portfolio mix, the Investment Checkup can be much more useful. Personal Capital would outperform all other Robo-advisories if this assessment were just focused on the free service and the value it offers.

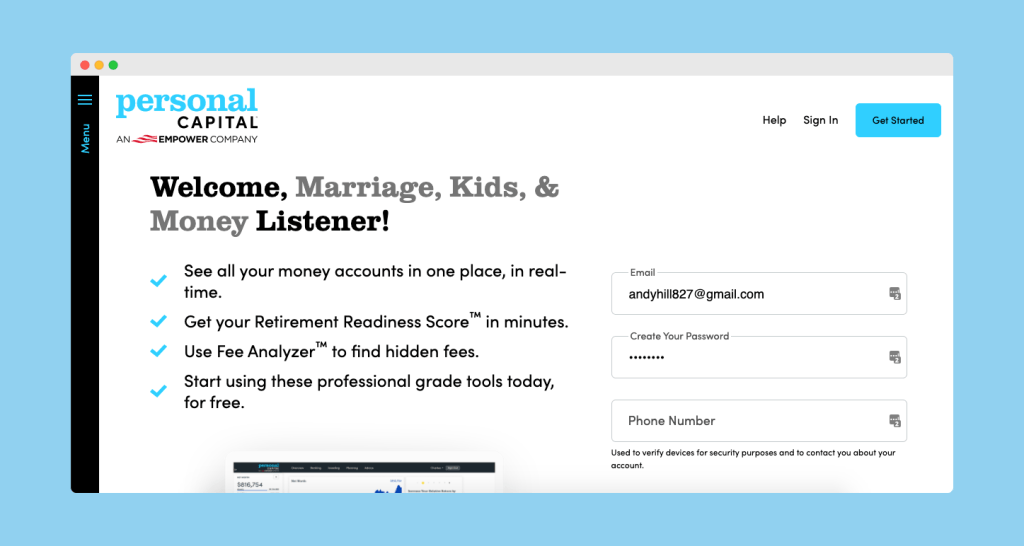

Creating a Personal Capital Account – Step by Step

It just takes a few minutes to create a free account with this service, which is also accessible as a mobile app. The program will next ask you things like when you plan to retire and how much money you have now invested. This will aid you in evaluating your existing financial and retirement objectives in the future.

Explaining the process of Account Set up

- You’ll need to integrate all of your financial accounts, including checking, savings, and investments after your account is set up and complete. Personal Capital integrates with thousands of well-known financial institutions, so you should have no trouble finding yours.

- After you’ve set up your new account and synchronized your financial accounts, you’ll be able to get a glimpse of your net worth and cash flow in the dashboard. Scroll down to see graphs of your expenditure and cash flow over the previous 30 days, as well as your portfolio’s balance and allocation status.

- You may create a monthly budget after your accounts are linked. Either scroll down the dashboard or go to the “Banking” tab and select “Budgeting.” You may view all of your account transactions from there.

- Now that you’ve figured out your personal income, spending, and bills, it’s time to dive into the most exciting part of Personal Capital: the investment tools! You may examine all of your holdings, watch the balances of all of your investment accounts, track the performance of your assets over time, or look at the Allocation or Sectors of your investments under the “Investing” page.

- A popular feature is the Retirement Planner. We even prepared a whole post about how to utilize it and what it can do for you. It basically answers the question, “Do I have enough money set up for retirement?”

- The best aspect about utilizing a free service like Personal Capital is that you can utilize the data it provides to improve your investment or retirement strategies. There are certain financial milestones that must be met in order to retire comfortably, and Personal Capital’s tailored guidance will assist you in achieving these goals.

Final Remarks

Personal Capital offers a significant edge over typical human investment consultants, who charge between 1% and 1.5 percent of your portfolio’s value to handle it. Personal Capital is the place to go if you’re searching for a similar level of service but don’t want to pay the exorbitant fees.

Personal Capital is a fantastic personal financial tool since it handles everything: budgeting, retirement planning, and investment. Not every platform has everything. Personal Capital’s financial software is free to use, and you aren’t obligated to employ their wealth management services.

The finance software from Personal Capital is presently the greatest online solution for keeping track of your investments. You may use it to manage your investment accounts, unlike some other money management systems. This is why we’ve included it on our list of investing tools to consider.

The retirement planner is second to none, and I found it to be quite useful in a variety of role-playing scenarios. For high-level advice, the investing checkup tool is fantastic. The financial management service is less expensive than the typical 1 percent to 2 percent fee charged by traditional advisers. However, when compared to other Robo advisers, it isn’t inexpensive.

Personal Capital is a blessing for people who don’t know how to properly deploy their money. If this describes you, a lower-than-average-cost financial counseling service might be considered.

Things People Ask About Personal Capital

Is Personal Capital legitimate?

Personal Capital is a reputable and legal FDIC-insured firm that provides a variety of services. Personal Capital Cash is a fantastic match for people who want to keep track of their spending, investments, and total net worth all in one place. Yodlee Interactive and Personal Capital have partnered to store and safeguard customer brokerage credentials.

It’s difficult to know how to bank and invest properly online these days, especially with fresh data breaches occurring all the time. Personal Capital is one of the most popular personal financial websites today, and it is completely free to use.

Is Personal Capital worth the fee?

Personal Capital may or may not be suitable for you, depending on your goals. It’s definitely worth a look if you’re seeking free money management tools. The firm provides several free services.

If you’re thinking about utilizing Personal Capital as a wealth management tool, there are a few things to consider. To use this service, you’ll need at least $100,000. Personal Capital is attempting to compete directly with high-fee financial consultants such as Edward Jones by focusing on higher-net-worth clients.

Personal Capital’s costs are far lower than those charged by typical financial counselors. You don’t have to pay trade commissions because wealth management, trade expenses, and custody fees are all covered. Even if you don’t utilize the wealth management service, every account receives a specialized adviser. Each of the firm’s advisors is said to have around 200 customers, and you may book a consultation with them.

Does Personal Capital sell your data?

On the official website, we read that they will never sell or let your information be used for anything other than marketing our own products and services. As a matter of fact, they have never disclosed sensitive financial information with our marketing partners, such as account numbers, precise account balances, or transaction history.