Lending Club is a peer-to-peer (P2P) internet lending marketplace that eliminates the need for a bank. Investors give money to borrowers directly through the website, allowing both parties to profit from the interest rate set for each loan.

Furthermore, the entire transaction takes place online, obviating the need for often humiliating face-to-face encounters that are typical with bank loans. The Lending Club procedure benefits both the investor and the borrower, therefore it’s a win-win situation. The loan amounts on LendingClub vary from $1,000 to $40,000. The minimal amount you must borrow varies from state to state. Residents of all 50 states can apply for a loan with LendingClub. The loan duration is either 36 or 60 months. In your state, some sums and term durations may be unavailable.

If LendingClub offers you a loan with a high interest rate, you should compare rates between credit cards for individuals with terrible credit and loans, as a credit card may provide a lower APR and better terms. You can receive the greatest bargain by weighing the benefits and drawbacks of your selection.

LendingClub offers personal loans with fixed rates ranging from $1,000 to $40,000. The repayment periods range from three to five years, and the whole application, approval, and funding procedure usually takes no more than seven working days. Borrowers get their money through a bank transfer.

Other lenders cannot charge you on LendingClub’s behalf since LendingClub does not impose an application fee or a brokerage fee.

On personal loans, LendingClub charges an origination cost of 1% to 6% and a late payment fee of $15 or 5% of the missed payment amount, whichever is larger. If you pay off the loan early, there are no prepayment penalties. And the rate of the platform is 4 / 5.

What is Lending Club and What Does it Do?

LendingClub is a fintech in the United States that offers a range of different products and activities through a digital network. This was the first peer-to-peer lenders to register its offers with the Securities and Exchange Commission (SEC) as securities and to provide secondary market credit trading. Before discontinuing the peer-to-peer lending strategy in the autumn of 2020, LendingClub was the world’s largest peer-to-peer lending platform. Up to December 31, 2015, the firm claims to have originated $15.98 billion in loans using its platform.

Borrowers may use LendingClub to establish unprotected personal loans ranging from $1,000 to $40,000. Three years is the usual borrowing term. On the LendingClub website, investors may search and browse loan listings and choose loans to participate in depending on the information provided about the borrower, loan size, loan grade, and loan purpose.

WebBank, an FDIC-insured, government industrial bank located in Salt Lake City, Utah, also provides typical direct-to-consumer loans, including vehicle refinance transactions. The loans are allocated to other financial institutions rather than being financed by investors.

Lending Club bought Radius Bank in 2020 and stated that its peer-to-peer lending platform will be close down. Existing cardholders will keep receiving interest on current notes until they are paid off or default, but there are no new loans accessible for individual investors. Existing loans can no longer be sold on a resale market, as they formerly could.

Lending Club Review – Feature Overview

It should be mentioned that the dashboard and interface of the application are pretty convenient. Getting personal counsel on your financial decisions may be beneficial, especially if that advice comes from an expert. If you utilize LendingClub, you’ll miss out on that experience. As easy as the web interface is, you’re simply entering data and receiving a result, with no context provided. This might leave you with a lot of unanswered questions.

Within a few minutes, you should be able to see your interest rate range and offers. LendingClub may additionally need you to produce proof of certain income and employment papers, and your online account dashboard contains a to-do list of verifications you must complete. By signing into your account, you may check the progress of your application at any time.

What Lending Club Has to Offer

Many of LendingClub’s rivals’ personal loans have higher beginning rates than LendingClub’s. The lenders offer initiation and overdraft payments, but no rate reduction for establishing randomized controlled trials, which some lenders provide to encourage customers to pay on time.

Lending Club also Offers co-signed and joint loan options and Offers direct payment to creditors with debt consolidation loans. It should also be mentioned that only three or five-year payback periods are available. The company is also well-known for having a customer-centric approach and the Member Center is available to assist borrowers in managing their finances and credit.it makes the process way more efficient for them.

Lending Club Personal and Business Loans

LendingClub loans have clearly taken off, as the firm has grown to become the biggest online personal loan provider in the United States, with much more than $35.9 billion in loans since its founding in 2007. In 2017, LendingClub made $8.987 billion in loans.

Many of LendingClub’s rivals’ personal loans offer greater beginning prices than LendingClub’s. The lenders offer initiation and overdraft payments, but no rate reduction for establishing autopay, that some borrowers provide to entice customers to pay in full. Personal loans from LendingClub may be utilized for practically any large cost, such as:

Credit card debt repayment

Debt consolidation

assisting with special events

Taking care of unforeseen house repairs

Paying for medical expenses

Lending Club Auto Refinancing

WebBank, an FDIC-insured, government industrial bank located in Salt Lake City, Utah, also provides typical direct-to-consumer loans, including vehicle refinance transactions. The loans are allocated to other financial institutions rather than being funded by investors. According to the lender, these loans may be utilized for a variety of significant costs, but credit card refinancing and debt consolidation are two of the most common.

Borrowers can apply for a balance transfer loan, which is created particularly to assist borrowers with debt consolidation. Credit card refinancing, new big purchases, and debt consolidation are all common applications. These loans were used for refinancing a house (43.36 percent), paying off credit cards (17.89 percent), and other purposes (38.85 percent ).

Lending Club High-Yield Savings Account

Individual investors may now learn more about LendingClub’s Founder Savings Accounts. These is the accounts they indicated when they revealed last October that their market maker platform will be shut down.

The Founders Savings Account will help shareholders to store their money in an FDIC-insured savings account that will earn a higher return than conventional savings accounts. Of course, this isn’t a replacement for investing in LendingClub notes; rather, it’s a method to keep your money earning while you figure out what to do with it.

There’s an auto-save function that will automatically transfer money from your existing Notes account to your personal savings account every week. The Radius Bank application will also allow you to access your account. There are no charges, no minimum balance requirements, and the account is guaranteed by the Federal Deposit Insurance Corporation up to $250,000.

The Biggest Advantage of Lending Club

The company has an outstanding performance rating in the financial market, which is due to several factors which are also believed to be the main advantages of the company as a whole. For example, in the long Loan Terms, the loan might be extended to three or five years of repayment.

As for Soft Pull, When comparing loan options, there is no need for a hard credit inquiry to evaluate pricing. It will enable you to browse around without jeopardizing your credit score. This means that the process for the users is pretty efficient and beneficial as well, allowing them to keep their performance without losing anything.

Low credit score is also one of the major advantages. The minimum credit score accepted by LendingClub is 600. Of course, with that credit score, the interest rate may not be optimal, but it may be a decent deal for consumers with poor credit who are often forced to accept substandard deals.

The Biggest Disadvantage of Lending Club

It is no surprise that there is not any financial company that is 100% beneficial for the users. Lending Club is not an exception as well. Some of the main disadgavnategs, based on the customer experience are:

Low credit score: The minimum credit score accepted by LendingClub is 600. Of course, with that credit score, the interest rate may not be optimal, but it may be a decent deal for consumers with poor credit who are often forced to accept substandard deals.

Origination Fee – LendingClub will provide you an interest rate after evaluating your credit risk, but part of it will be an origination charge, which will be deducted from your loan. It’s worthwhile to weigh the pros and cons of firms that don’t charge an origination fee.

Other Costs: There are a variety of additional fees. If you pay by check, you’ll be charged $7, but there’s no charge if you set up a debit from your bank account. If you don’t have enough money in your bank account to cover the monthly amount, you’ll be charged $15. A late payment fee of 5% of the outstanding installment amount or $15, whichever is larger, is charged.

Is Lending Club Safe?

LendingClub loans have annual percentage rates that do not exceed 36 percent, which is the rate cap that most consumer advocates suggest. In addition, unlike many paydays and other predatory lenders, the firm utilizes information like credit history and income to assess a borrower’s capacity to repay.

LendingClub is open about its costs and provides answers to commonly asked questions about its loans on its website.

Does Lending Club Have Fees?

The usual annual percentage rate (APR) for LendingClub is between 5.99 percent and 35.89 percent. In addition, a 1% to 6% origination charge is deducted from the total loan amount.

You start repaying the loan when we agree on an interest rate and duration. The peer-to-peer network distributes the funds and collects your monthly payment. For initiating the loan, they charge a fee. Then they pay me and the other investors the interest you’re paying on your loan each month.

For borrowers with weak credit, LendingClub is generally not the greatest option. That would come with a high-interest rate and a hefty origination charge, so you’d be better off with a different sort of loan.

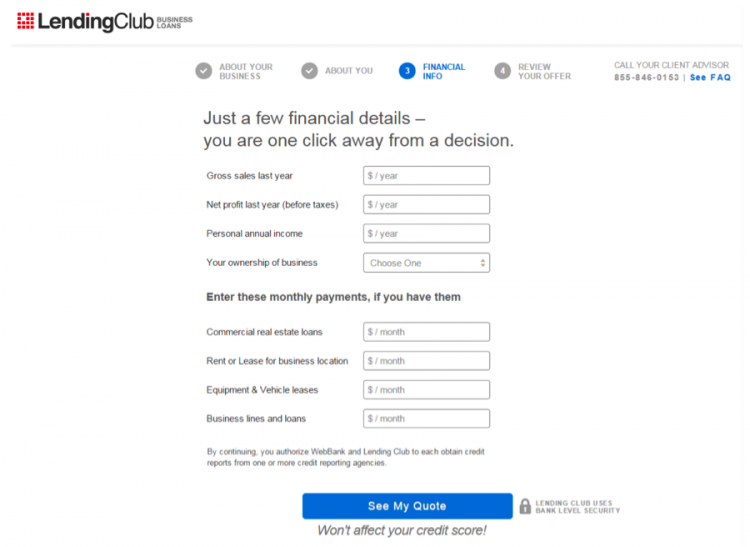

Creating a Lending Club Account – Step by Step

The application is available online and takes only a few minutes to complete. You may also include a co-borrower on your application to improve your chances of getting a higher rate. For the initial application, you’ll need the following information:

- Name

- Include your address, phone number, and email address in your contact information.

- Year of birth

- The number assigned by the Social Security Administration

- Individual earnings

- Why are you seeking a personal loan and how much do you want to borrow?

Within a few minutes, you should be able to see your interest rate range and offers. LendingClub may additionally need you to produce proof of certain income and employment papers, and your online account dashboard contains a to-do list of verifications you must complete. By signing into your account, you may check the progress of your application at any time.

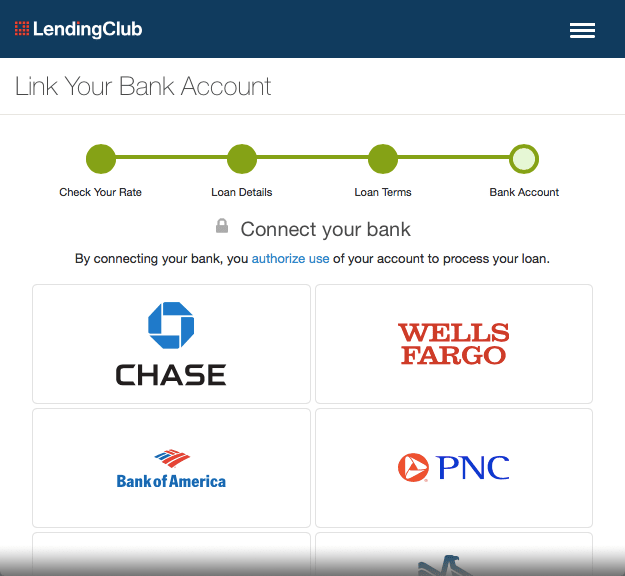

Your money will be transferred to your bank account within two to four business days once the verification procedure is completed.

Final Remarks

Lending Club caters mostly to customers with excellent to excellent credit ratings. Their loans are a godsend to small company owners and others who have been harmed by banks tightening their lending requirements across the board.

Because of the firm’s size and several years of experience as a lending marketplace, both borrowers and investors may be certain that they are dealing with a reputable company. While the approval procedure takes a bit longer than that of some other P2P lenders, this is due to their commitment to allowing consumers to choose which loans they wish to participate in rather than maintaining a huge amount of money from the investors.

Personal loans from LendingClub might be an excellent option for those who need money for medical bills, weddings, relocating expenses, or debt consolidation. While co-signers are not accepted by LendingClub, co-borrowers may apply.

Peer-to-peer financing is absolutely worth keeping in mind as you examine your various loan choices. It can allow you to borrow money for things that regular lenders won’t, such as trips or weddings. Before asking for offers on LendingClub, shop around to see what interest rate you can obtain for identical borrowing from other sources.

Things People Ask About Lending Club

Is the Lending Club legit?

LendingClub loans have annual percentage rates that do not exceed 36 percent, which is the rate cap that most consumer advocates suggest. In addition, unlike many paydays and other predatory lenders, the firm utilizes information like credit history and income to assess a borrower’s capacity to repay.

LendingClub is open about its costs and provides answers to commonly asked questions about its loans on its website.

Getting a personal loan to pay off debt wasn’t uncommon even 15 years ago. except that the LendingClub loan was not from a bank. It originated with ordinary folks like you and me. It is a legitimate and not unusual option for normal individuals to loan money to other regular people who can’t or won’t receive a loan through traditional lenders.

Does a Lending Club loan hurt your credit?

No, reviewing your rate and applying for a loan with LendingClub will not harm your credit score. It does a mild credit inquiry in order to obtain information about your creditworthiness. This is solely available to you, not creditors or anybody else who looks at your credit record. If you get a loan via LendingClub, your credit report will show a hard credit inquiry that might impact your credit score.

Keep in mind that your credit score is affected by new debts. They can help you enhance your credit over time by demonstrating that you can make on-time monthly payments.

Your credit score will not be affected if we are unable to provide you with a loan. Soft credit inquiries will be visible to you, but they will not be visible to creditors or other users of your credit report.

Does Lending Club Call your employer?

You’ll need revenue to pay back the loan, and you may need to prove it by submitting papers such as W-2 Forms or tax filings, or by having Lending Club call your employer. For funding, you’ll also have to link a U.S. bank account to Lending Club. Your credit ratings will also be checked by Lending Club.