Betterment is the world’s biggest independent online financial counselor, dedicated to assisting you in determining what you should do with your money. They created the first-ever Robo-advisor tool to automatically develop and manage short and long-term investment portfolios during the 2008 economic crisis and they do it all with a personalized strategy based on your particular profile.

They provide a variety of financial products and services to assist you with anything from today’s cash to tomorrow’s savings and beyond.

Whenever it comes to automated, low-cost investing and managing money solutions, Betterment is a market leader. They provide a user-friendly yet powerful platform that helps you monitor your assets, prepare for retirement expenditures, organize your savings, choose the proper accounts, and much more. They’re also a trustee, which implies they work in your best interests. The overall rating of the company is 4.7/5 which is considered to be one of the best.

What is Betterment and What Does it Do?

Jon Stein, a Columbia Business School MBA graduate, and Eli Broverman, a lawyer from NYU School of Law, established Betterment in 2008 in New York City. Stein and his Google software engineer roommate Sean Owen began developing Betterment’s first web platform in 2008, utilizing a Java application.

Broverman and Stein were ready to provide financial advice to consumers online as an SEC-registered investment advisor, and they also opted to provide broker-dealer services. To develop Betterment’s broker-dealer division, the company hired Ryan O’Sullivan, a “serial entrepreneur.”

Broverman and Stein were ready to provide financial advice to consumers online as an SEC-registered investment advisor, and they also opted to provide broker-dealer services. To develop Betterment’s broker-dealer division, the company hired Ryan O’Sullivan, a “serial entrepreneur.”

On April 7, 2009, Betterment, LLC was formed as a Delaware corporation. Betterment Holdings, Inc., the parent company for Betterment LLC and Betterment Securities, was founded in Delaware on January 29, 2008.

Automated goal-based investing is the company’s core service, and it maintains a portfolio of passive index-tracking equities and fixed income exchange-traded funds. There are taxable and tax-advantaged investment accounts available, as well as standard and Roth individual retirement accounts. It has lately expanded its offerings to include human financial counselors as well as checking and savings accounts.

Betterment Review – Feature Overview

After you’ve established your account, you’ll have access to a variety of valuable information and tools. The dashboard is very useful since it summarizes your existing accounts, investment performance updates, product and service suggestions, the option to integrate additional outside investment accounts, and more. There’s a lot to take in, yet it doesn’t seem overwhelming.

Betterment can sync any external bank accounts, investment portfolios, loans, mortgages, and credit cards so they show on your account dashboard. Betterment can offer you advice on how much you’re losing to fees and idle cash using the dashboard, which gives you a complete picture of your net worth in one location. Betterment invests every cent of your money by acquiring fractional shares as tiny as 1/1,000,000 of a share, putting your money to work. The DIY investor simply does not have access to fractional shares.

Dividends are immediately reinvested, ensuring that your money is put to the greatest possible use. Betterment also reinvests dividends sensibly. A dividend received from a stock fund is not automatically recycled in that fund. Betterment searches for areas of your account where you’d be underinvested and puts the money there immediately.

Betterment isn’t able to replace Mint or other budgeting applications, unfortunately. The dashboard will not reveal specific credit card transaction details, but it will display account balances, providing you a big-picture perspective of your financial situation.

What Betterment Has to Offer

Based on the betterment service review, the true attraction of the company is the services it offers, which were previously only available to clients who could afford to employ an investment manager. Auto-deposit is available from every Robo-advisor. Betterment is the only company that provides Smart Deposit, an automatic cash management solution that puts your extra income to work.

Betterment’s ETFs have an expense ratio of 0.13 percent to 0.16 percent, so investors need to add 0.15 percent to the management fees above to get a good idea of what they’ll spend. When compared to traditional investment management approaches, that’s still a good deal, and Betterment’s individualized advice is worth it.

Betterment has applications for both iOS and Android that allow consumers to use a touch ID or a PIN to access and manage their accounts. And the betterment app review indicates that you can also use an Apple watch to view objectives and account information, or log in to your account via the Internet from anywhere you have an internet connection.

Betterment Automated Investing

For those of us who lack the necessary knowledge or time, investing money may be a tough and intimidating task. Betterment thinks that investing is all about making your long-term financial objectives, like kitchen improvements, a down payment on a home, or your child’s school, as simple as possible. They take the guesswork out of investing with their Invest product and automated platform.

- Recommend investing portfolios based on your goals, timeline, and personal characteristics.

- Rebalance your portfolio automatically to keep your investments on pace.

- Any dividends given out by firms in the portfolio should be reinvested.

Betterment Retirement Planning

The days of worrying if you’re saving enough to be appropriately prepared for retirement are over. RetireGuide from Betterment estimates your retirement gap or the difference between how much cash you’ll have and how much you’ll need in retirement. RetireGuide, unlike some of the other retirement calculators, considers your complete life, from where you reside to your present savings and your spouse’s assets.

Your charge tier will not be affected by market changes that lead your account to fall below the threshold for a better pricing tier. If you have several accounts, including taxable and retirement accounts, the total amount is used to determine the fees you’ll pay.

Betterment Goal Tracking

The website of Betterment is meant to walk you through the process of establishing and monitoring objectives. The procedure is straightforward to follow through to completion. When you go to their FAQs and ask a question, the site keeps track of the items you’ve already read. Certain actions, including clicking the Support link, start a new tab, so you may find yourself with many good tabs.

The Biggest Advantage of Betterment

There are some major important advantages that the company has compared to other competitors. Account creation is simple and quick, which means that people who are interested in engaging in the activity are pretty time-consuming.

Prior to financing, portfolios are completely visible, which means that it does not require special skills or anything like that to analyze the ongoing process on your account. The ability that allows the users to link External accounts to specific goals is also worth mentioning.

Also, it is also possible, at any moment, to add a new objective and easily track your progress which makes the process way more convenient and efficient.

Sometimes, the users want to upgrade their account types of portfolios, which the website also allows without the problem and they are able to change the risk of their portfolio or move to a different type of portfolio with ease. And the last but not least, a two-way sweep is available in the checking and cash reserve features.

The Biggest Disadvantage of Betterment

Despite the fact, that the website or platform gives those who are involved in the financial market great help, it does not mean that everything is unique and there are no cons. There are definitely some disadvantages that many people wish were not, however, it is an undeniable part of the process.

The planning tool continuously encourages users to fund a Betterment account, which many users claim to be irritating or tempting, and is dedicated to earning as much money from the client as possible.

Also, a financial planner consultation costs $199–$299 under the basic plan, which is an extremely high cost in comparison to other companies that operate in the field and assist the clients with the same help. Also, exchange-traded funds are used in socially responsible portfolios (ETFs).

And also, the portfolio is not eligible for margin lending, secured loans, or borrowing alternatives, which sometimes restricts the liquidity and freedom of the client’s activity.

Is Betterment Safe?

You anticipate a clear set of security safeguards to secure your information when you give personal information and can combine other accounts. To do this, Betterment has implemented industry-accepted and established security features such as robust browser encryption, secure servers, identity verification services, two-factor authentication, and more.

The security provided by Betterment is adequate. Two-factor authentication is available on the internet and in mobile apps. Betterment does not carry additional Securities Investor Protection Corporation (SIPC) insurance, but trades are processed by Apex Clearing, which includes risk management capabilities. Betterment clients do not engage in high-risk trading, and there is no margin lending available, thus further SIPC coverage is doubtful. If you have more than $500,000 in your account or more than $250,000 in cash, you should consider transferring the excess to a business that offers extra insurance.

Does Betterment Have Fees?

When it comes to price, Betterment is a bargain when compared to rival investing and cash management systems. They are also highly transparent, which is extremely beneficial to inexperienced investors. Here’s a short rundown of their major services’ prices.

On invested balances, Betterment charges a modest 0.25 percent yearly asset-based fee. Furthermore, each of the portfolios’ investments has an annual expense ratio that ranges from.03 percent to.50 percent.

There are no monthly account fees, maintenance costs, minimums, or withdrawal fees with the checking account option, and they refund all ATM expenses globally, including 1 percent Visa transaction fees on foreign transactions. There are no fees on balances, no transfer limitations to and from other accounts, and no minimum balances with Betterment’s Cash Reserve/savings account option.

Creating a Betterment Account – Step by Step

A 401(k) is the simplest method to begin investing in today’s society. But what if your boss doesn’t have one or you work for yourself? Then, Betterment is an excellent place to start investing if you don’t have a lot of money. Many people, however, become stopped at this point. They believe that getting started with investing is difficult and time-consuming, however, based on the betterment software review It’s not true in this case.

Explaining the process of Account Set up

- To begin investing, you’ll need the following items: Your full name and mailing address, log in and password for your bank checking account, how much money are you willing to put down to get started ($1 or more) and how much would you like to invest automatically each month ($1 or more).

- On the first screen, tell us how old you are, how much money you make annually, and where you work.

- You have the choice of doing either a Standard or an Express setup.

- I recommend going with the Express option and letting the computers handle the heavy lifting.

- On the next page, Betterment recommends an investment allocation for you depending on your age.

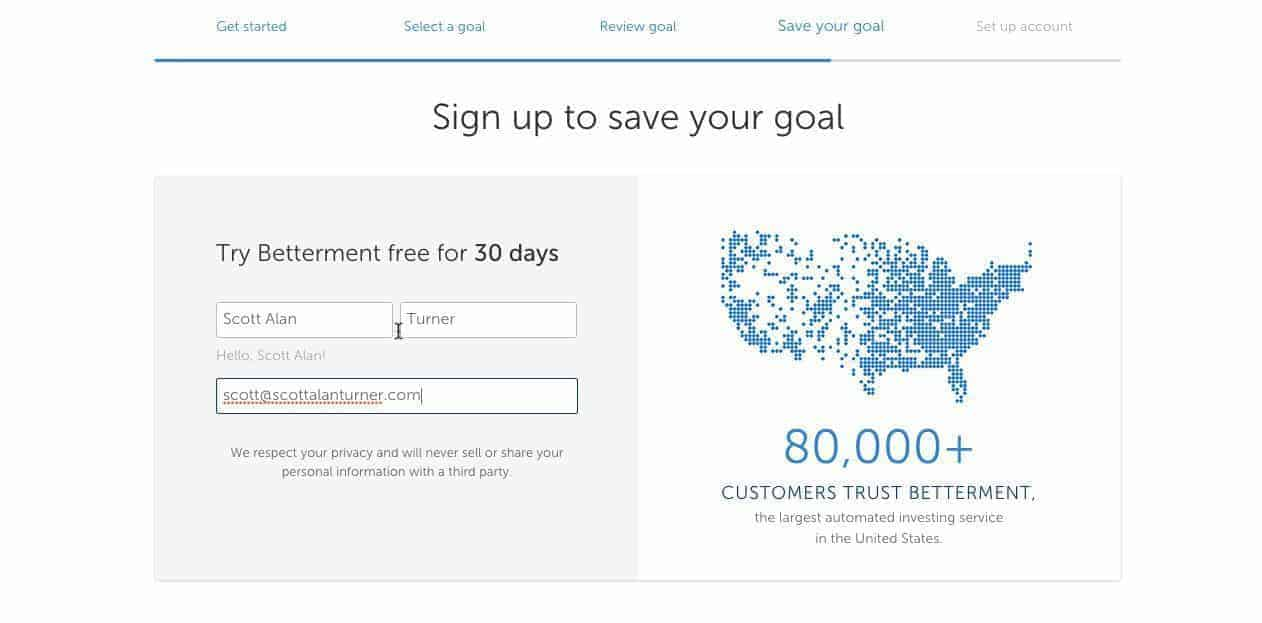

- Betterment is available for a free 30-day trial. To store your information, you must first establish an account by entering your name and email address.

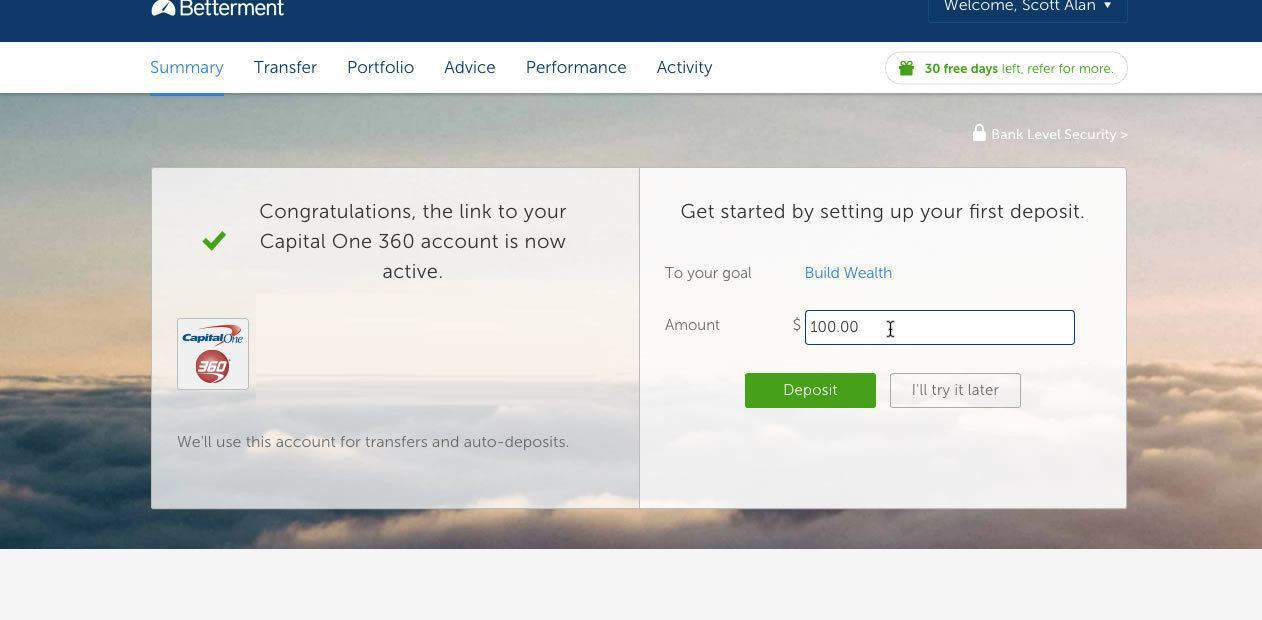

- You link your Betterment investing account to your online bank on the next screen. Betterment will be able to withdraw money from your bank account and transfer it to your Betterment investing account via a secure connection.

- It’s a good idea to check your email program right now. You must do this in order to make a deposit with Betterment

Final Remarks

Betterment is a great option for investors searching for a low-cost, hands-off, and accessible way to invest. Automated rebalancing, Smart Deposit, and Tax Loss Harvesting are just a few of the services that aren’t available to DIY investors. Customers may expect 4.30 percent greater returns as a result, according to Betterment. A DIY investor who wants to research the market and loves doing their own portfolio rebalancing can avoid Betterment’s costs, but they’ll miss out on many of Betterment’s tools that assist optimize after-tax returns. Betterment money manager review proves that they offer the services of an investment manager for a fraction of the cost. So, if you’re looking for a low-cost asset management solution based on good investing principles, look no further.

Betterment is a competent Robo-advisor that should appeal to both venture capitalists and those who are a little more well-heeled, thanks to a couple of management plans. Betterment excels at the fundamental tasks of investing, tax reduction, and cash management, and it does so at a very affordable cost.

Things People Ask About Betterment

Is my money safe with betterment?

One of Betterment’s recommended goals is a safety net, or emergency fund, in which it recommends investing 15% in stocks and 85% in bonds, with the goal of matching or beating inflation. Short-term savings, such as an emergency fund, should not be invested, according to conventional wisdom, because you may require access to the account immediately.

According to Betterment’s testing, this allocation is a fair option to cash, but you’ll have to determine whether your result makes your emergency fund. Many folks would be able to sleep easier at night if they had at least part of this money saved. Furthermore, the firm acknowledges that withdrawing funds from your safety net account may result in capital gains tax consequences, including short-term capital gains, which are taxed at a greater rate than long-term profits. Withdrawals from a regular savings account aren’t subject to taxation.

What is the average return on betterment?

Investors can choose from three those certain portfolio choices: a smart beta portfolio, which strives for higher-than-average returns by accepting systemic risk; an income portfolio comprised entirely of bonds; and social responsibility portfolios, which include ETFs that invest in stocks whose business models correspond with these social causes.

An expense ratio is a proportion of your investment in a mutual fund, index fund, or exchange-traded fund that is paid annually. For every $1,000 invested in a mutual fund with a 1% cost ratio, for example, you will pay the fund $10 every year. These costs can reduce your portfolio’s returns if they’re too high, but the expense ratios of the funds utilized in Betterment portfolios are low.

Is betterment good for beginners?

Betterment’s interface is simple, user-friendly, and packed with instructional resources, making it our top recommendation for newcomers. It also provided financial harvesting for all accounts, regardless of size, as well as a variety of checking and savings account alternatives, making it our top cash management pick.

Betterment is a competent Robo-advisor that should attract both new investors as well as those who are a little more possibly the best, thanks to a couple of management strategies.