TD Ameritrade is one of the most popular online brokers, and it has maintained its lead among novice investors. On-ramps to TD Ameritrade’s services are built on a number of social media sites, including Twitter and Facebook, to reach clients and prospects. Customers may choose between TD Ameritrade’s standard website, mobile applications, and thinkorswim, which is geared for derivatives-focused aggressive traders, once they’ve joined up.

TD Ameritrade has been bought by Charles Schwab, but the merger of the two brokerage behemoths is anticipated to take many years. Meanwhile, TD Ameritrade is operating as a distinct business, so we’ll take a look at how it fares as an independent brokerage to see whether it’s a suitable fit for your investment requirements.

What is TD Ameritrade and What Does it Do?

TD Ameritrade is an electronic trading platform that allows customers to trade capital assets such as common stocks, preferred stocks, futures contracts, exchange-traded funds, currencies, options, cryptocurrency, mutual funds, fixed income investments, margin lending, and cash management.

Interest income on margin balances, fees for order execution, and payment for order flow are all sources of revenue for the firm. By 2023, the firm will be a wholly-owned subsidiary of Charles Schwab Corporation, and its services and accounts will be merged with Schwab’s. The company’s activities are being relocated to Schwab’s headquarters in Westlake, Texas. Ameritrade, the company’s original name, was formed in 1971. It was renamed TD Ameritrade after acquiring the US business of TD Waterhouse from Toronto-Dominion Bank in 2006. Charles Schwab Corporation purchased it in 2020.

CEO Joe Moglia stated in May 2008 that he will step down as CEO and become Chairman. COO Fredric Tomczyk, who was formerly Vice-Chair of Corporate Operations at Toronto-Dominion Bank, took over as CEO. The firm purchased Scottrade, located in St Louis, Missouri, in September 2017, creating St Louis the company’s second-largest hub. In February 2018, customer accounts were transitioned. On January 28, 2021, GameStop, BlackBerry, AMC, Koss Corporation, and Nokia, among other massively shorted companies, were prohibited from trading by the business and other trading platforms.

TD Ameritrade Review – Feature Overview

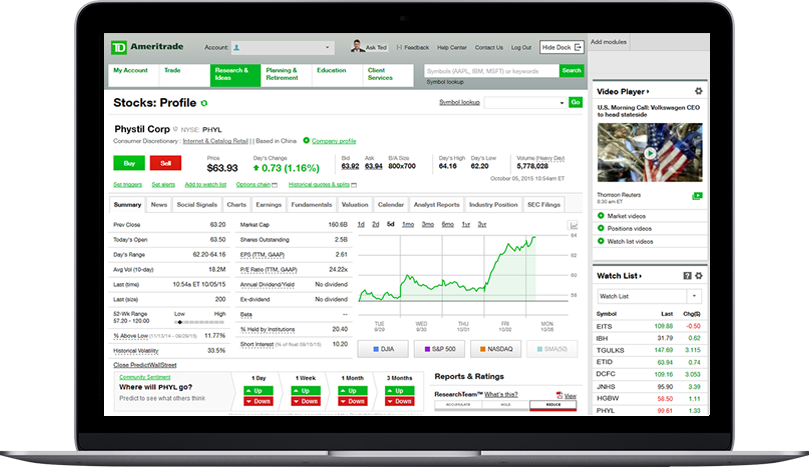

The thinkorswim platform may be customized to your precise needs, with tabs enabling quick access to the functions you use the most. The website’s customization choices are restricted, but thinkorswim allows you to customize everything from the tools on each page to the typeface used to the backdrop color.

On thinkorswim, you may customize every element of your trading defaults. The website, on the other hand, does not provide you the same amount of control over trade defaults. Because most personalization choices are kept in the cloud, they will follow you from device to device after you’ve set them up.

Thinkorswim on the web features live trading and paper money, the trading simulation, and all of the asset classes included in the downloaded version, as well as the same data sources and trading engine. Your static and dynamic watchlists are the same. The primary difference between the web and downloaded versions is that the web version is more transaction-oriented and has a simpler look. The greatest difference between online and desktop is that on the web, instead of having many tabs, all accessible functions are gathered into one view. The online version is not as feature-rich as the desktop or native mobile apps, but it will be enhanced when clients request specific capabilities.

TD Ameritrade offers native iOS and Android apps, as well as a mobile online experience that resizes the screen to fit the device you’re using. If you create a watchlist on one platform, it will be available on other platforms as well. This is especially useful for people who go back and forth between the normal website and thinkorswim. On mobile devices, you may trade all of the accessible asset classes.

For aggressive traders and investors alike, the thinkorswim mobile app offers a wealth of functionality. The options, stocks, and futures workflows are simple and powerful. There are several features that make the mobile app a comprehensive solution for most trading needs, such as streaming real-time data and the option to trade directly from charts. The standard mobile platform is nearly comparable to this one.

What TD Ameritrade Has to Offer

Because TD Ameritrade is one of the largest online brokers in the United States, it offers a variety of platforms for traders of all skill levels. The numerous educational programs assist beginning investors to gain confidence and encourage them to branch out into different asset classes as their abilities develop. The thinkorswim platform provides active investors and traders with all of the data, graphing, and tools they need to discover market opportunities. The sheer amount of research and tools accessible through TD Ameritrade might be daunting.

TD Ameritrade offers in-person education in more than 280 locations, as well as numerous training routes available on its website and mobile apps, thanks to the physical facilities it acquired when it purchased Scottrade some years ago. The TD Ameritrade Network also provides nine hours of live programming in addition to on-demand video.

Mobile Trade Experience

For aggressive traders and investors alike, the thinkorswim mobile app offers a wealth of functionality. The options, stocks, and futures workflows are simple and powerful. There are several features that make the mobile app a comprehensive solution for most trading needs, such as streaming real-time data and the option to trade directly from charts. It’s a simple move because the normal mobile platform has nearly comparable functionality as the website.

Trading Technology

The way a broker routes your order impacts whether you’ll get the best price available at the moment you place your deal. This is referred to as price improvement, and it essentially entails a sell above the bid price or purchase below the offer price. The order routing algorithm at TD Ameritrade looks for both price improvement and quick execution of the client’s complete transaction. According to the firm’s price improvement data, most marketable stock orders earn a little more than 0.015 cents per share in price improvement on average. On thinkorswim, clients may create and backtest trading systems, as well as route their own orders to specific market centers, but they cannot execute automated trades.

Education

For trading and investment education, TD Ameritrade sets the bar high. It provides a variety of learning options, such as live video, recorded webinars, articles, courses with quizzes, and information grouped by ability level. A significant portion of the information is also available in Mandarin and Spanish. The website can provide a tailored experience for customers by using artificial intelligence to recommend content and the next action.

With new investors entering the trading market in 2020, TD Ameritrade launched two new learning routes geared at novice investors, including personal finance and growth stock investing for beginners. The TD Ameritrade Network broadcasts nine hours of live video every day. The network was created with advanced traders in mind, but it has now grown to include opportunities for new traders to make their first deal. TDAN programming is available through native applications for iOS, Android, Amazon Fire, and Roku.

The Biggest Advantage of TD Ameritrade

Clients may easily access account data, balances, balance history, positions, news, and more on TD Ameritrade’s conventional website, which has been adapted for mobile browsers. The well-designed mobile applications are meant to provide consumers with a simple one-page experience that allows them to check in on the markets and their accounts fast.

The toolset of the thinkorswim downloading platform has been mostly transferred to the web. Customers may trade stocks, options, futures, options on futures, and FX on the web using its sophisticated analysis tools and real-time streaming data. TD Ameritrade makes the platform available in both traditional and simplified Chinese to reflect the company’s increasing presence in Asia.

TD Ameritrade offers in-person education in more than 280 locations, as well as numerous training routes available on its website and mobile apps, thanks to the physical facilities it acquired when it purchased Scottrade some years ago. The TD Ameritrade Network also provides nine hours of live programming in addition to on-demand video. And the last but not least, The amount of real-time data that can be streamed on thinkorswim, the website, and mobile apps is limitless.

The Biggest Disadvantage of TD Ameritrade

It does not matter how successful the company is on the financial market, in this dizzy industry, anything can be guaranteed, this is why it is regarded every company to have its own flaws in many different directions. Customers may be required to use several platforms in order to access their favorite tools. On thinkorswim, there are a lot of options-specific tools, but basic research for stocks and fixed-income tools are mainly only available on the website. This is a problem that many major brokers with various platforms face.

Clients of TD Ameritrade have access to a wide range of account kinds, which could be beneficial. It can, however, be confusing for novice investors who aren’t sure what they’re talking about. Clients should be given additional assistance during the setup process to ensure that they are starting with the right account type.

The commission on over-the-counter trading is $6.95 per trade and unless clients take steps to shift capital into money market funds, they are paid a pittance of interest on uninvested cash.

Is TD Ameritrade Safe?

The security at TD Ameritrade meets industry standards:

For mobile app login, clients can utilize biometric authentication with fingerprint and face recognition, which makes the access way more convenient for the users. The security algorithm at TD Ameritrade detects the computer from which a customer has previously accessed the account, and if an unfamiliar computer tries to access the account, a series of profile questions are used to validate the client’s identity.

Through additional coverage supplied by London insurers, TD Ameritrade offers each customer $149.5 million in securities protection and $2 million in cash protection. The Identity Theft Resource Center reported no serious breaches at any TD Ameritrade locations through November 2019.

Does TD Ameritrade Have Fees?

Before opening an account with a broker, read the lengthy fee disclosures. While nothing stood out as especially onerous in our assessment of TD Ameritrade’s costs and perks, there are a few fees (and rebates!) that we believe you should be aware of before creating an account.

Many investors appreciate the convenience of having a debit card attached to their brokerage account, but they don’t like the fees that come with it. With regard to debit cards, TD Ameritrade has a particularly customer-friendly policy, since it reimburses clients for any ATM fees paid by rival banks’ ATMs. You won’t incur an ATM fee whether you use your card every day or once a decade since reimbursements are limitless.

Brokers dislike sending papers by snail mail, therefore they charge a premium for paper statements. Account-holders with balances under $10,000 will be charged $2 for each printed statement. If you sign up to get your statements online, you won’t even be aware that this charge exists.

Creating a TD Ameritrade – Step by Step

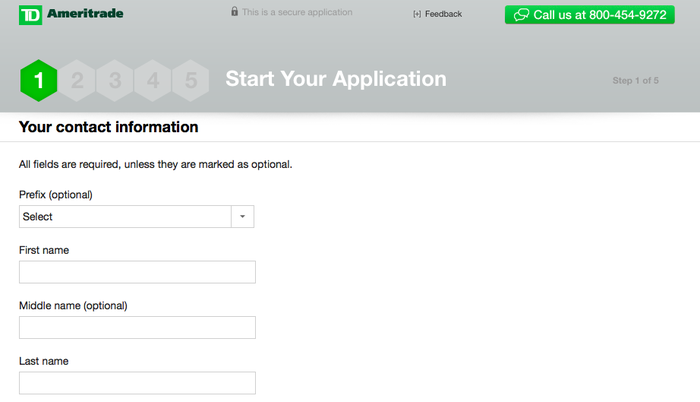

- Begin submitting your application – To get started, go to the TD Ameritrade account application page. In this area, you’ll fill out some basic information about yourself (name, email, etc.) as well as choose the sort of account you want to open. The steps for dealing with a TD Ameritrade individual brokerage account may be found here.

- More personal information, such as your Social Security number, postal address, date of birth, and job information, will be entered in this area.

You’ll also be questioned whether you or anybody in your family works for a stock exchange, or if a member of your immediate family is a director or 10% shareholder of a publicly-traded firm. You’ll almost certainly say “no.”

- Review and modify data – This is a very easy phase. All you have to do now is double-check the information you’ve previously supplied for the account to ensure it’s right. Once you’ve completed that, simply click the continue button to go to the next stage.

- Accept the terms – This section contains some technical information that you must accept. The client agreement, account manual, company continuity plan statement, and IRA account agreement disclosure are all available in PDF format. If any of them relate to you, make sure you read them thoroughly before agreeing to establish an account.

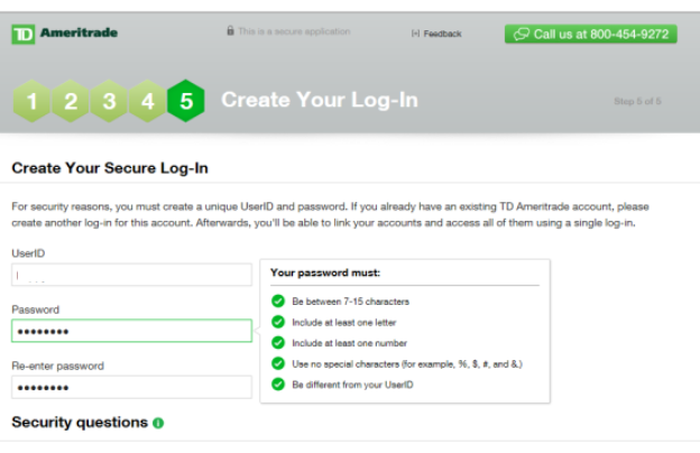

- Set up your online login – You’ll enter your username, password, and security questions here. The account will then be established, and you will be able to fund it, select trading features, and change your account preferences, according to the firm. On the last page, you’ll also get your official account number.

Final Remarks

The numerous platforms offered by TD Ameritrade make research and trading available to a wide variety of investors and traders. Newer investors can work their way up the chain, learning new methods and asset classes as they come across them in the wealth of financial information available to them.

Traders and active investors will like the thinkorswim platform’s features, which include the option to build custom indicators and share asset screens with others. Of course, Charles Schwab’s takeover of TD Ameritrade creates some doubt. Combining these two big brokers will take years, but it will almost certainly necessitate the phase-out of some functionality on one of them.

Transitions like this may be excruciating, especially for traders who have spent time configuring an interface. TD Ameritrade is a good bargain now, regardless of what these two large brokers may become in the future. You may now receive plenty of outstanding research, limitless streaming real-time quotes, and a superb trade execution engine at a very affordable price thanks to TD Ameritrade’s fee reduction.

Things People Ask About Lending Club

Is TD Ameritrade good for beginners?

TD Ameritrade is our number 1 recommendation for beginners because of its extensive instructional programs, live events, and user-friendly platforms. TD Ameritrade’s thinkorswim platform also makes it an excellent choice for more experienced investors who want to be more hands-on with their investments. With new investors entering the trading market in 2020, TD Ameritrade launched two new learning routes geared at novice investors, including personal finance and growth stock investing for beginners.

How much does it cost to create an account with TD Ameritrade?

There is no requirement for a minimum deposit to start an account. Special promotional deals, on the other hand, may contain conditions. The minimum electronic funding amount is $50. A minimum of $2,000 is required for account margin or option rights.