Finding the finest portfolio tracker is straightforward because technology has always been at the forefront of financial markets. Long before Amazon and Google, hedge firms utilized algorithms and automation. At companies like TD Ameritrade and Personal Capital, computers now manage our money entirely. But technology isn’t simply for those who want to “set it and forget it.” Portfolio tracker systems are useful for investors who wish to keep a close eye on the market. Today, use our list to find a portfolio tracker.

What is a Portfolio Tracker, and how does it work?

A portfolio tracker is a tool or service that allows you to follow your individual holdings’ movements. You may examine how your current allocation compares to your long-term objectives and how your portfolio is performing in comparison to the market. You may import portfolios from your investment accounts or manually construct portfolios to try out different methods. Remember that monitoring your investments too frequently might lead to excessive trading, but using a portfolio tracker to maintain track of your asset allocation is a simple and effective method to do so.

Most brokerages provide some form of tracking and research tool, but you can only utilize that broker’s accounts. If you have a TD Ameritrade 401(k) and a Vanguard IRA, you’ll have access to excellent research, but you won’t be able to combine the accounts to obtain a whole picture. You can better assess your entire allocation and develop a more focused strategy with a portfolio tracker.

Portfolio Tracker Characteristics

Great portfolio trackers offer a broad selection of investment tickers to choose from, as well as excellent research tools. The following are the criteria we considered to choose our favorites:

Cost – To begin started, all of the portfolio trackers on our list provide a free option. Some offer paid add-ons to improve the experience, but a free option for beginning users is essential.

A large number of assets can be tracked. What use is a portfolio tracker if you can’t track your investments? A decent tracker will allow you to keep track of various sorts of investments, including stocks, bonds, and ETFs. There are even cryptocurrency portfolio trackers available.

Speed. You want a tracker that loads quickly on your phone or desktop, but price updates demand quickness as well. Stock quotations should be posted in real-time on a tracker. You won’t be able to trade if the prices are more than 15 minutes old.

An easy-to-use UI. A portfolio tracker should be simple to use and understandable to your parents or grandparents.

Best Portfolio Trackers

Delta Investment Tracker

Delta is a minimalistic iOS and Android app featuring an appealing “dark mode” that’s beneficial for low-level illumination as well as those with visual impairments. All major stocks, cryptocurrencies, ETFs, indices, mutual funds, bonds, futures, and options may be tracked in real-time with Delta Investment Tracker. All major stocks, cryptocurrencies, ETFs, indices, mutual funds, bonds, futures, and options may be tracked in real-time with Delta Investment Tracker.

Follow your favorites to get alerted when a big change occurs for an asset you’re interested in. There are no delays, and you are constantly up to date. Delta also provides a clear picture of your overall portfolio balance, profit, and loss over time. Whether you have one or many portfolios, you can see all of your assets and trends in one location. Furthermore, Delta adjusts to you, regardless of whether you are completely invested in stocks, crypto, or ETFs, thanks to its dynamic characteristics.

The asset information views offered by Delta go beyond what other investment trackers have to offer. You have access to your existing position, market value, percent change, and realized gains. All of your portfolio assets, beautifully integrated into a detailed picture of the main market.

Sharesight

Sharesight was a true game-changer in the online portfolio management industry. It has won several awards, including Benzinga’s Best Financial Advisor and Wealth Management Platform. You can follow the real performance of all your listed equities from over 30 worldwide stock exchanges with Sharesight.

With their custom groups function, you’ll be able to track numerous asset classes in one location, including currencies, private equity, alternatives, bonds, property, and other unique investments. Sharesight makes it simple to evaluate your portfolio and discover how you stack up against the competition. It also maintains track of all your dividends, making tax season much easier.

Premium plans for sophisticated investors are available for $12 per month.

Desktop, iOS for iPhone, iPad, Apple Watch, Google Play, and Amazon are all available.

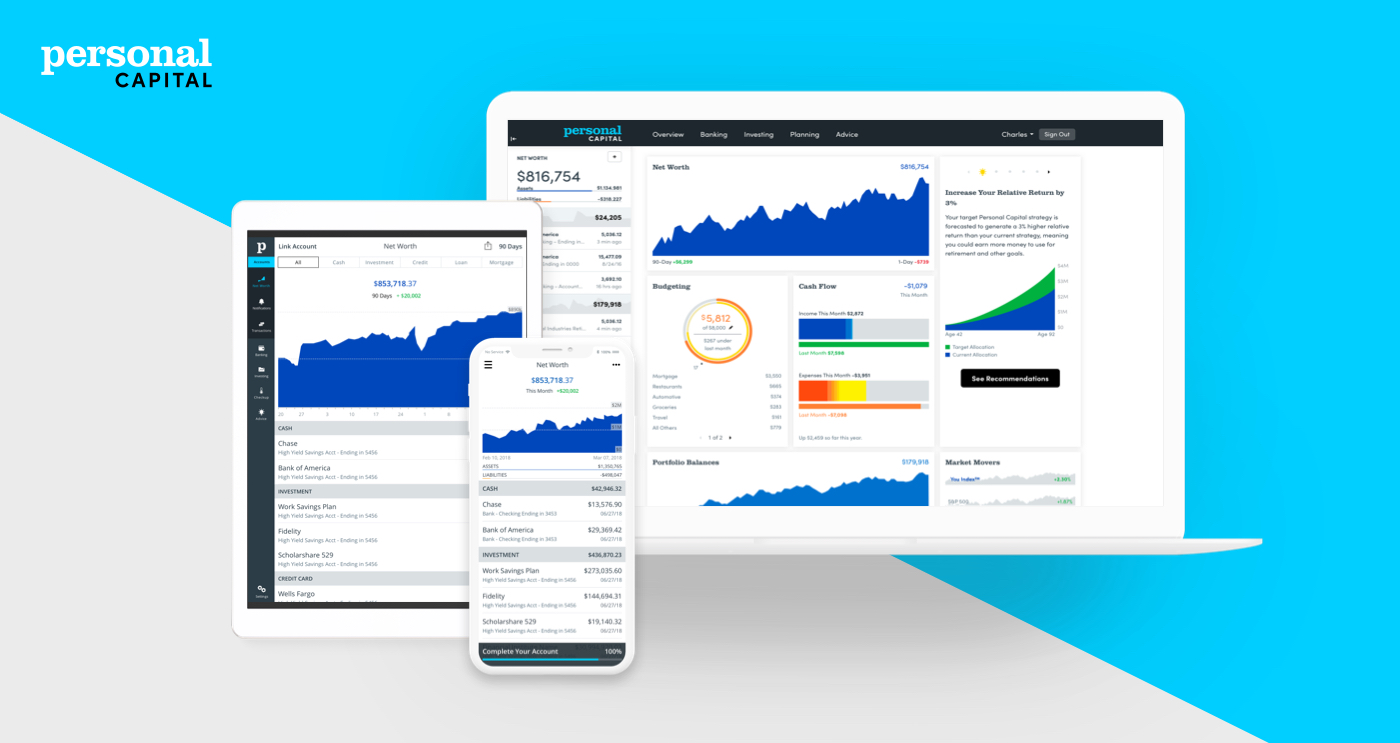

Personal Capital

First and first, it’s important to clarify that Personal Capital does not want to be labeled a Robo-advisory, preferring to be referred to as a digital asset management service that also provides customized financial planning assistance. Nonetheless, the firm was one of the first to put tools in the hands of investors and automate aspects of portfolio management. Due to the firm’s superior technology’s ability to properly manage risk and taxes, Personal Capital is our top pick for portfolio management.

Personal Capital may be interacted with in two ways. The first is a free planning tool that gathers information from all of your financial accounts and provides recommendations to help you increase your profits. It’s certainly worth a look, regardless of where you bank or invest. The asset management service, which requires a minimum account size of $100,000 to begin, is the second way to connect with Personal Capital.

Personal Capital is similar to Mint, but with a focus on investment. Personal Capital keeps track of your payments, bank accounts, and credit card statements in addition to your investments. Because you’ll know where every dollar you earn goes, this all-encompassing picture makes maintaining and supporting your assets a breeze.

Personal Capital will assess your risk profile and ensure that your asset allocation is on track. You’ll receive everything Mint has to offer, plus a stronger emphasis on investment. It’s also available for free on iOS, Android, and the web.

Free of charge

Desktop, iOS for iPhone, iPad, and Apple Watch, and Google Play are all available.

M1 Finance

M1 Finance offers a one-of-a-kind blend of automatic investment and high customization, allowing clients to build a portfolio that meets their particular needs. It is not, however, a consulting firm. The business presently manages over $2 billion in assets and has over 500,000 clients.

M1 Finance is our top pick for experienced investors because of its unique blend of automated investment and high levels of customization, which allows customers to build a portfolio suited to their particular needs. It’s also our top pick for cheap expenses since it doesn’t charge any fees for portfolio administration, trading, or deposits or withdrawals to a linked bank account.

M1 Finance displays your possessions as pie slices. All you have to do now is allocate a proportion to each slice and fund your Pie, and you’ve got yourself a stock portfolio. You may also use M1’s Expert Pies function to make your own pies. For individuals who wish to invest passively while maximizing profits, it offers an in-house asset management staff. This function is especially beneficial to investors who are switching from a Robo-advisor. M1 Finance also does not charge any brokerage charges or fees.

Ziggma

Ziggma is a portfolio management software that was created with the goal of making investing simple. Many investors find it difficult to maintain track of their portfolios while also failing to identify efficient ways to maximize risk-adjusted returns. The Ziggma Portfolio Manager uses professional-grade tools and data to help investors remain on top of their portfolios and discover the greatest opportunities depending on their long-term goals.

Ziggma users have access to intuitive portfolio analytics, innovative tools, and best-in-class data for stock research by securely integrating their investment accounts to Ziggma utilizing Plaid’s leading technology.

The quickest stock and ETF screener on the market is Ziggma’s portfolio management tool. You will receive:

- A portfolio analysis that is intuitive

- Instruments for monitoring

- You’ll be able to link your investing accounts together.

- Using Ziggma’s own approach, a portfolio quality check is performed.

- Portfolio models may be used to benchmark and get ideas.

Are you unsure if Ziggma is suitable for you? Ziggma is ideal for the following people:

Investors that are active

Those that purchase and hold are known as buy-and-hold investors.

Investors looking for a good deal

Beginners

Status Money

With Status Money, you can keep track of your money, see how you stack up against your friends and get anonymous advice. You can even make money while improving your financial situation.

Install the Status Money app on your iOS or Android device to see how you stack up against your peers. You’ll be able to keep track of and manage your whole financial life by comparing yourself to your peers. Examine your expenditures to see whether you’re wasting money, paying too much in interest, or not saving enough. Your comparisons are kept private.

Privately ask questions and exchange information, or get the most up-to-date financial news and analysis from the community. You may obtain recommendations and monetary incentives using Status Money. Simply recommend your friends to win incentives. You may earn as much as you want, and your prizes never expire.

Interactive Brokers

Due to its plethora of features for experienced investors interested in following global investment trends, Interactive Brokers (IBKR) comes towards the top of our 2020 assessment. The business makes it a point to link to every electronic exchange across the world, allowing you to trade stocks, options, and futures around the clock. Interactive Brokers launched its Impact Dashboard in the autumn of 2020, which helps clients connect their own beliefs with their portfolios, as well as new ESG research and tools that assist customers to find international possibilities.

Interactive Brokers’ PortfolioAnalyst is an online performance analysis and reporting tool. PortfolioAnalyst helps you assess the performance of your portfolio by allowing you to create and save reports based on a set of measurement criteria, as well as compare your data to industry standards. You may also see the performance of any of your accounts, including Interactive Brokers and investment and non-investment accounts, at any financial institution. Then you may view accounts, asset types, positions, and transactions by drilling down.

Kubera

Kubera, the world’s most contemporary portfolio tracker, is named after the Hindu God of Wealth. It allows you to keep track of all of your assets and investments in one location online. Kubera helps you track the value of cryptocurrencies, your internet domains, loans to family and friends, and personal physical assets like your home and car, in addition to standard assets like equities and bonds.

Kubera provides you with a real-time overview of all of your investments in an intuitive interface that is as simple to use as a spreadsheet. Using account aggregation technology, the web service links to over 20,000 institutions across the world, allowing you to keep track of both your domestic and international cash holdings.

Kubera bills itself as the world’s most advanced portfolio manager. All of your assets, both traditional and crypto, are tracked in one location by the platform. Once you’ve entered all of your investments and assets, you’ll get a glimpse of your net worth. Connect your online brokerage accounts or add individual stocks to see their current worth. Get the most up-to-date balances from your crypto wallets and exchange accounts, or just add the coins to keep track of the worth of your crypto portfolio in your home currency.

Kubera allows you to link your accounts with over 20,000 banks across the world, and you can even add the worth of your house, as well as any cars or web domains you own. Adding assets is as simple as adding a new row in a spreadsheet.

Achee

Choose achee if you want to keep track of your investment performance as simply as possible. In your selected currency, you may follow investment expenses, corporate activities, and the success of your investment portfolio, as well as view your gain/loss against a base currency.

Choose achee if you want to keep track of your investment performance as simply as possible. In your selected currency, you may follow investment expenses, corporate activities, and the success of your investment portfolio, as well as view your gain/loss against a base currency.

You may also obtain a portfolio health check and advice on how to enhance performance by comparing your portfolio to important benchmarks. Your stocks, cryptocurrencies, fixed assets, and cash accounts are all conveniently tracked and organized on the site. It includes more than 170,000 stock tickers from more than 70 worldwide exchanges, including Nasdaq, NYSE, and others. You may pick among over 7,000 cryptocurrencies and all of the world’s main currencies.

Achee also protects your sensitive personal information with the most up-to-date encryption technology standards. You may also obtain a portfolio health check and advice on how to enhance performance by comparing your portfolio to important benchmarks. Your stocks, cryptocurrencies, fixed assets, and cash accounts are all conveniently tracked and organized on the site.